Unboxing BendDAO #02: Decomposing BendDAO’s Revenue Stream

In the previous article, we covered how DAOs can become more transparent with open and interpretable financial information (i.e., financial statement). Financial reporting provides a source of truth to DAO members, thereby building trust among stakeholders in and out of a DAO.

In today’s newsletter, we will deep-dive into BendDAO’s revenue stream — that is, how BendDAO generates income. And by the end of the article, you will have a clear picture of BendDAO’s income statement (this beautifully structured revenue stream) in your mind.

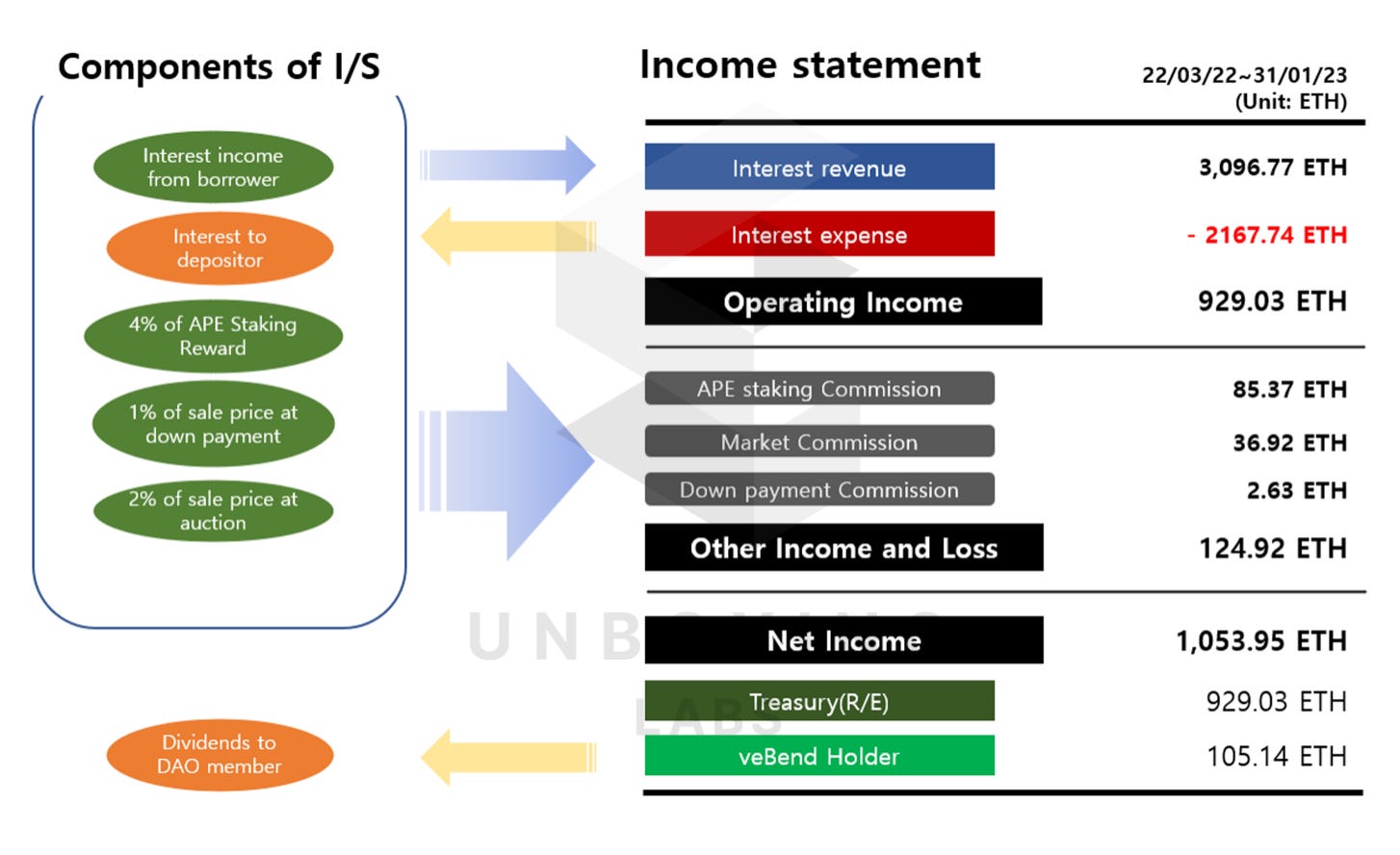

This may look complicated as of now, but soon you will have a full understanding of what each account really means.

Table of Contents

The Four Sources of BendDAO’s Revenue

Revenue Stream Part 1: Interest Income

ㅤㅤQ1. How is the interest income generated?

ㅤㅤQ2. How much money does BendDAO make from interest income?

Revenue Stream Part 2: Three other Sources of Income

How BendDAO Distributes Revenue

Sharing the Revenue by Investing in veBEND

The Challenge of Implementing an Accrual Basis Accounting System

ㅤ

The Four Sources of BendDAO’s Revenue

According to the docs, BendDAO has four different sources of revenue:

interest income from borrowers

commission income (exchange sales)

commission income (Down Payment sales price)

and commission income ($APE staking reward)

BendDAO’s revenue stream

Among the four, BendDAO’s main source of income is the interest income from borrowers. This shouldn’t be very surprising, taking into account that BendDAO is an NFT loans platform.

Let’s first deep-dive into BendDAO’s interest income, and then examine the remaining three income sources.

Revenue Stream Part 1: Interest Income

Q1. How is the interest income generated?

In order to understand the interest model, we first need to know how the lending pool system works. When depositors deposit ETH into BendDAO’s lending pool, the collected ETH (along with ETH deposited by BendDAO at the point of launch) becomes the source of money where borrowers can borrow against their collateralized NFTs. And when the borrower pays back the interest, BendDAO uses it to reward the depositors.

Doesn’t this process sound familiar to you? Yes, BendDAO works just like a commercial bank in traditional finance.

Look at the diagram above for a better understanding. This is exactly how commercial banks earn money in the traditional finance world. Banks (in this case, BendDAO) make a profit by imposing higher interest rates on the borrowers than what they have to give away to the depositors.

Q2. How much money does BendDAO make from interest income?

You may be curious about how much money BendDAO actually makes. Unfortunately, only with the easily accessible data, it is almost impossible to identify the accurate amount of BendDAO’s interest revenue.

Let’s take a look at BendDAO’s website. While you can see the real-time APR for both depositors and borrowers, the chart only shows the current APR. I.e., we do not have access to the historical APR. Moreover, these are annual rates, which makes it harder to calculate how much BendDAO earns daily.

For this reason, many people (even BendDAO operators themselves) refer to the Dune dashboard created by a BendDAO enthusiast (@cgq0123). However, the dashboard only keeps track of cash-in and cash-out. In other words, even this dashboard may not be the best way to identify BendDAO’s income because it keeps track of the income on a cash basis.

While we can see how much cash is currently deposited in BendDAO’s treasury, it doesn’t capture a borrower’s interest amount that is accumulated daily. In other words, someone’s payable loan amount might be increasing every day, but this wouldn’t be reflected in cash basis model. However, with financial experts and skilled data engineers in our team, we were able to use the accrual basis accounting to organize all the transactions that took place in BendDAO’s treasury wallet.

And here’s how we captured individual transactions to create an accrual-based journal entry.

Cf. What is accrual basis accounting?

Here’s a guide for those of you who are unfamiliar with the concept. Accrual basis accounting is an accounting method that records incomes and expenses before payments are received or issued. Unlike how cash basis accounting captures everything based on the in and out of cash, the accrual method records income/expense anytime a sales/purchase transaction occurs. For instance, when a company purchases supplies from a vendor but has not yet received an invoice for the purchase, the expense is still recorded as “accrued expense” even when there is no cash flow. Apply this method to BendDAO, and “interest receivable” will mark its daily income even when the loan is independent of the actual repaid cash amount. There’s a general consensus in traditional finance that a full understanding of income can only come from the accrual model.

Let’s take a look at the total amount of interest revenue keyed into the journal entry. Based on the sales transactions we captured and organized, BendDAO accrued a total interest of 3,096.77 ETH as of January 31, 2023.

And of the interest receivable, BendDAO had realized 1925.81 ETH of accrued interest. That is, 1,170.96 ETH still remain as interest receivable from borrowers.

Revenue Stream Part 2: Three other Sources of Income

Now that you have a good understanding of BendDAO’s interest income, you almost have the full picture of the revenue stream in mind. In this section, we’ll wrap up BendDAO’s revenue stream by analyzing three different types of commission income — commission income from 1) exchange sales, 2) Down Payment, and 3) $APE staking. Unlike interest income, these activities don’t happen so frequently.

First, there is commission income from exchange sales. BendDAO runs its own NFT Bend Exchange, where they liquidate collateral NFTs when a borrower fails to pay back the debt. Whenever an NFT is sold through an exchange, BendDAO charges 2% of the marketplace fee, thereby earning income. 64 NFTs took place worth a total of 1845.797 ETH*. From the point of its launch, BendDAO earned a total of 36.92 ETH (2% of the total) through its Bend Exchange.

* As of January 31, 2023 (the same applies to the numbers below)

BendDAO also charges a fee for Down Payment. Down Payment is BendDAO’s BNPL system, where a user can buy a blue chip NFT with a minimum down payment of 60%. 7 Down Payment activities have taken place so far, with a total volume of 263.29 ETH. With a 1% Down Payment fee, BendDAO’s commission income from Down Payment would be 2.63 ETH.

Lastly, BendDAO charges APE coin staking fee to those who deposit $APE to the BendDAO pool for the purpose of earning interest revenue. With 7,443 staking activities, BendDAO earned a total of 85.37 ETH (23,009.77 APE). While the first two types of commission income are partially distributed to the veBEND holders, the commission income from $APE staking is kept in the treasury. We’ll cover the details in the next section, so continue reading!

ㅤ

How BendDAO Distributes Revenue

Until now, we’ve looked at four different ways BendDAO earns revenue. Then, where does this revenue go to? Who will be benefiting from the revenue generated?

There are three main stakeholders involved in BendDAO’s revenue stream:

veBend holder,

BendDAO treasury,

and depositors.

Here, we don’t consider $BEND as revenue because it’s BendDAO’s native token. Therefore, borrowers and LP holders are not considered stakeholders in this article. Let’s revisit the diagram we saw in the beginning.

BendDAO’s revenue stream

To begin with, veBEND holders receive:

30% of the income generated from the lending pool (577.42 ETH as of Jan 31, 2023),

50% of the commission income from exchange sales (18.46 ETH as of Jan 31, 2023),

and 50% of commission income from Down Payment (1.31 ETH as of Jan 31, 2023)

Meanwhile, parts of the income are retained in the BendDAO treasury, specifically:

the remaining 50% of the commission income from exchange sales (18.46 ETH as of Jan 31, 2023),

the remaining 50% of commission income from Down Payment (1.32 ETH as of Jan 31, 2023),

and all of the commission income from $APE staking (85.37 ETH as of Jan 31, 2023).

Last but not least, depositors who stake ETH in the BendDAO pool receive 70% of interest income generated by the lending pool (1,348.07 ETH as of Jan 31, 2023).

Sharing the Revenue by Investing in veBEND

Reading this, you might have become bullish on BendDAO’s protocol and are willing to get on board with BendDAO’s success. Now what? The best way to join this protocol with manageable risk would be to become a veBEND holder, thereby sharing the profit from BendDAO’s lending protocol.

veBEND is a token you can receive by staking the BEND token, which gives you the right to vote and earn. Depending on how many veBEND tokens you hold, your voting/earning power increases proportionally. It is just like equity securities in the TradFi world; for instance, stocks. With stocks in hand, you receive dividends from the company proportional to the amount of stocks you have.

In TradFi, the amount of dividend depends on a company’s dividend policy. In the case of BendDAO, you would have to figure out the size of the revenue share that is allocated to veBEND holders. And in that process, you’ll have to consider variables such as the amount of BEND staked in the pool, and the price of BEND token at the point of purchase. Taking these variables into account, you can calculate the rate of return (a.k.a. dividend yield in web2).

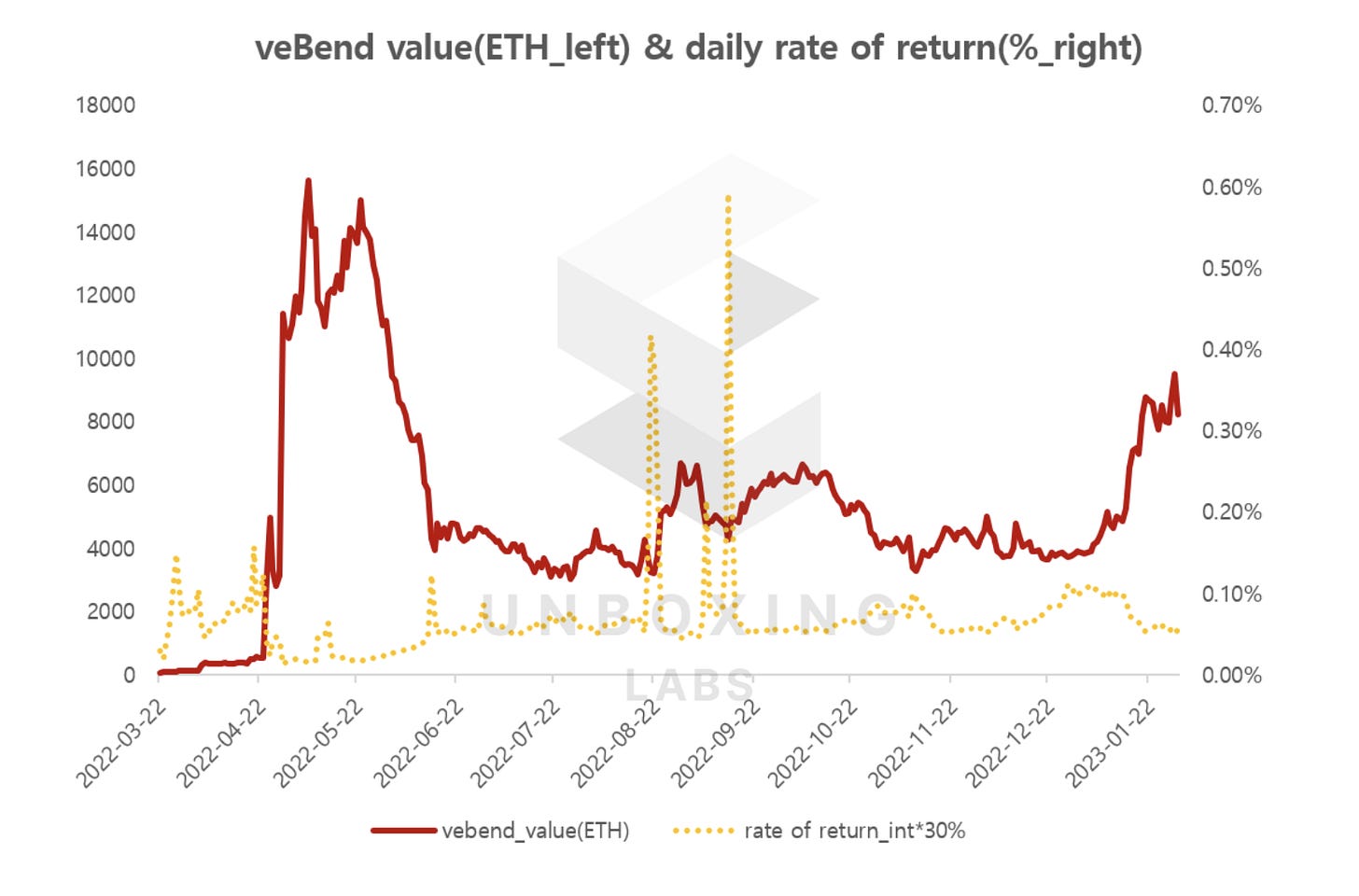

Just by reading this, we can feel it’s an overly complicated process. But don’t worry, we have done the work for you. The following graph shows veBEND’s past daily rate of return (ROR).

And by calculating 1) the receivables turnover ratio, 2) average daily interest rate, and 3) the growth rate of loan amount, we can estimate the future ROR.

Receivables turnover ratio = 2,013.10%

This means that, on average, BendDAO will redeem a loan of 100ETH 20 times per year. BendDAO took average 18.26 days to redeem its receivables.

Average daily interest rate = 0.0762%*

When a depositor stakes 1 ETH in the pool, he/she will receive average 0.000762 ETH a day.

Daily average from Mar 22, 2022 to Jan 31, 2023

Monthly growth rate of accrued interest = 47.11%*

Monthly average from April 1, 2022 to Jan 31, 2023

Through this data, we can conclude that the total “dividend” will increase 47.11% monthly. However, because total veBEND amount is to increase 51.16% monthly, the ROR (based on ETH) is likely to decrease. Still, the interest rate may increase due to the fluctuations in the utilization rate, resulting in average 20~27% annual ROR.

The Challenge of Implementing an Accrual Basis Accounting System

While reading the article, you might have wondered, “why didn’t BendDAO implement the accrual model at the first place?” Well, the accrual basis bookkeeping must’ve been a very, very complex job for BendDAO considering its operational system. If we understand its operational structure, we will come to a conclusion that adopting the accrual model would’ve been a big challenge for BendDAO.

BendDAO calculates interest with a smart and complicated internal system composed of following factors:

Two internal tokens

Bend Interest Bearing WETH Token

Bend Debt Bearing WETH Token

Two indices

Liquidity Index

Borrow Index*

* originated from the famous DeFi protocol, Aave

In the process of creating a financial statement, the UnboxingLabs team analyzed this system down to the very detail. But as this is optional information and not critical to understanding the article, you may jump to the next part if you wish. ;)

Previously, we mentioned that there are two different types of interest rates: one for borrowers (Borrow Rate) and one for depositors (Deposit Rate). They are determined in real-time* depending on the utilization rate of the lending pool. The utilization rate, marked is the x-axis of the graph below, is computed as (borrowed money) / (total money in the reserve).

* Every 15 seconds (the time it takes for a block to be created)

Every time the utilization rate, borrow rate, and deposit rate are updated, the change is reflected in the liquidity index and borrow index, creating a trend that would look like this:

These two indices later become the exchange rate between Bend IBT-WETH and Bend DBT-WETH. Summing up:

Bend Interest-bearing WETH Tokens (IBT)

= amount of ETH BendDAO owes to depositors

Bend Debt-bearing WETH Tokens (DBT)

= amount of ETH borrowers owe to BendDAO

Through this, BendDAO is able to keep track of how much ETH to give back and forth.

Conclusion

That was a long journey! Now, let’s recap. The reason a financial statement is so powerful is that we can summarize all of this information in one-pager. Let’s revisit the income statement we covered in the beginning.

This single picture can explains how BendDAO earns revenue, how big their revenue is, and how much revenue is returned to the veBEND holders. Isn’t this amazing?

This is not the end of what we can learn from BendDAO’s case. In the next newsletter, we will deep-dive into the risk factor of BendDAO investment. To give you a rough idea, the lending pool works just like the cycle in the diagram below. With this, you can identify how different factors influence one another. Next week, we will identify different risk factors in BendDAO investment and major risk indicators.

If you liked our article, subscribe now to receive our latest updates and follow our updates on our twitter: @unboxingLabs